Please, note that any information provided below is for informational purposes only and should not be treated as investment or financial advice of any kind.

Yesterday, on May 18, 2021, Bitcoin (BTC) markets witnessed the second largest sell-off in its history. Bitcoin (BTC) flash-crashed to $38,000, recovered to $41,000 and then plummeted to $30,000 level, unseen since early January.

What triggered this sell-off? Are the worst liquidations yet to come?

A record breaker?

The answer is yes and no.

First and foremost, yesterday’s plunge erased ‘only’ 33 percent of Bitcoin (BTC) price overnight. To provide some background, during Black Thursday in Crypto, Bitcoin dropped from $8,280 to $3,700; losses exceeded 55 per cent.

Meanwhile, some records were registered. For instance, Bitcoin (BTC) price has never been so volatile in its history. In less than four hours, BTC/USD recovered from its local bottom at $30,000 to $40,442; Coinbase whales added 35% to its price.

Image by Binance

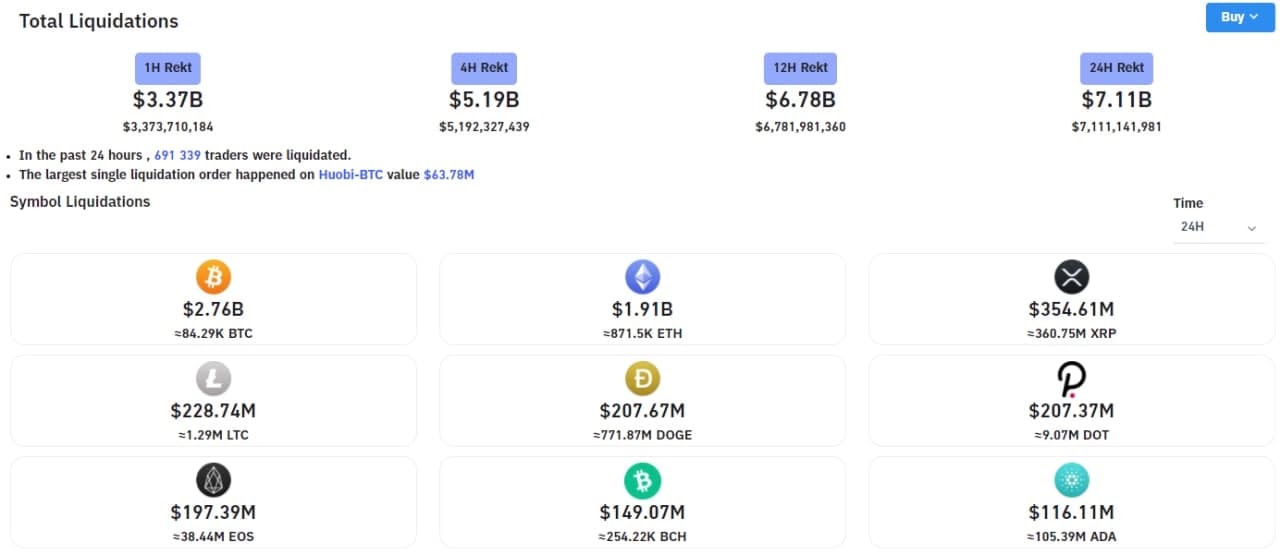

Also, cryptocurrencies markets witnessed jaw-dropping liquidations across all derivatives exchanges. Between 700,000 and 900,000 traders got liquidated while the net amount of their losses exceeded $7 billion. On Black Thursday that indicator barely surpassed $2.5 billion.

Image by ByBit

So, the doomsday power of this carnage should be attributed to the over-leveraged landscape of crypto markets. But who triggered the ‘cascade liquidations’?

Been a long time, China FUD

Two days ago, Chinese officials made the headlines in crypto again. National Internet Finance Association of China, the China Banking Association and the Payment and Clearing Association of China issued a joint statement that institutions in China are prohibited from operations with cryptocurrencies including DeFi-specific ones.

However, the eagle-eyed analysts noticed that, first and foremost, a variety of Chinese watch dogs are issuing ‘warnings’ of such type periodically.

Also, none of the three is actually a regulator. All of them are just sectoral unions yet very influential ones. But in a nutshell, this is a textbook example of ‘nothingburger’ on overheated markets.

All major cryptos were heavily overbought in early May. Lightning-fast altcoin season injected new life into half-forgotten dinosaurs of the crypto scene: Ethereum Classic (ETC), Stellar Lumens (XLM), Litecoin (LTC) and so on.

Then, the euphoria around Dogecoin (DOGE) copycats excited crypto newbies. However, Vitalik and Elon showed no mercy to them, as previously reported by GetBlock.

And no, China doesn’t ban Bitcoin (BTC).

So, what’s next?

Nobody knows.

The fact is, Bitcoin (BTC) looks terribly oversold in-between $30,000 and $40,000. Here’s why the funding indicator (the balance metric of derivatives exchange) is at its most ‘bullish’ levels since March, 2020.

Hash Ribbon, an integral indicator of miner-driver pressure on Bitcoin (BTC) price nears ‘Buy’ signal unseen since December, 2020. Once it was confirmed, BTC price tripled in three months.

Meanwhile, institutions should have been scared by yesterday’s armageddon. Some of them may start considering selling - at least, partial. We shouldn’t forget that the flagship corporation of the ongoing crypto rally, Microstrategy, purchased Bitcoin (BTC) at $24,400 average price. So, it can sell it with 100 per cent profit at $49,000 - and its price would immediately plummet to four-digit levels.

Do your own research, as usual. This correction won’t last forever - neither will this bullrun.

If you’re interested in investing in cryptocurrency, please don’t overlook what our partners in SimpleSwap are offering. Their exchange allows you to buy a plenty of cryptos including Bitcoin (BTC), Ethereum (ETH) or Litecoin (LTC) with other tokens or credit cards.