Polygon (previously Matic Network) has evolved into a flagship Ethereum’s full-stack scaling solution. As a result, its ecosystem of decentralized applications is the world’s fastest-growing one. Based on data by leading analytical dashboards, GetBlock prepared a brief review of what’s going on in Polygon (MATIC).

TL;DR

Polygon (MATIC) exploded onto the dApps scene in 2021 and established itself as one of the most DeFi-focused chains. Also, Polygon (MATIC) nodes are utilized by NFT-centric metaverses and gaming applications.

Polygon (MATIC) and its competitors: Are we still early?

To provide the context, let’s start from looking at Polygon (MATIC) from the perspective of a global decentralized applications ecosystem.

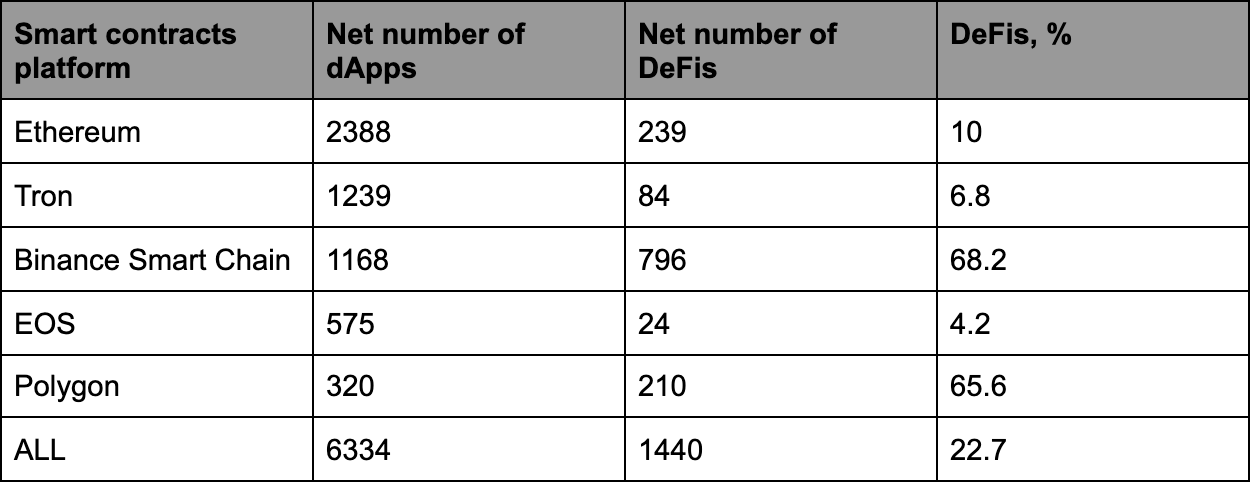

According to dAppRadar’s data, 6334 decentralized applications are active as of Q3, 2021. 1440 of them belong to the segment of decentralized finances (DeFis), the on-chain protocols for basic financial operations.

As displayed above, Polygon (MATIC) alongside Binance's Binance Smart Chain (BSC) are the most ‘DeFi-centric’ smart contract platforms. About two-thirds of their dApps are Defis.

In terms of all active dApps, Polygon (MATIC) nodes are responsible for 5% of all decentralized applications whilst Binance Smart Chain nodes are responsible for 18,4 %. Thus, Polygon looks like the promising decentralized application ecosystem with notable focus on DeFis.

DeFis and exchanges on Polygon (MATIC)

As Polygon (MATIC) fees are significantly less than that of Ethereum (ETH) and its first-gen scaling solutions, numerous DeFi heavyweights launched their versions on Polygon (MATIC). Aave Finance (AAVE) and 1Inch Network (1INCH) are the most popular of them.

At the same time, some protocols have chosen Polygon (MATIC) nodes as its primary platform. For instance, Beefy Finance and AES Finance have amassed over 100 million in total value locked.

QuickSwap and PolyDEX are two largest exchanges on Polygon (MATIC) nodes. Despite their trading volume can’t be compared to Uniswap’s metrics, they provide decentralized exchange services for thousands of crypto enthusiasts.

Games and NFT projects on Polygon (MATIC)

As of late July 30, 2021, three Polygon-based decentralized games amassed a six-digit sum on their balances. LoserChick, Cometh, and CremePieSwap represent full-stack GameFi ‘Play-to-Earn’ ecosystems. Besides the gaming engine, the last one also has a seamless integration with AMM-powered DEX on Polygon (MATIC).

Some NFT projects on Polygon (MATIC) are at the same time decentralized games. For instance, on-chain NFT project Marble.Cards is a tokenized card game. Artvatars is a core Polygon-based ‘pure’ marketplace for tokenized collectibles.

Gambling and high-risk apps on Polygon (MATIC)

Unlike Tron (TRX), Polygon (MATIC) isn’t focused on the onboarding of decentralized gambling products and high-risk schemes. The most interesting ones are MATICDice that commemorates the SatoshiDice game of early Bitcoiners and DecentralGames economic simulator.

PolySec and Polygonex are classic ‘high-yield’ passive income schemes based on multi-level structure of users’ investments.

Getblock.io is a leading provider of the access to Polygon (MATIC) nodes via API. Regardless of the ideology of your project, it can be on-boarded by Getblock instantly. Don’t hesitate to get in touch with our team in Telegram and Discord.