Please, note that any information provided below is for informational purposes only and should not be treated as investment or financial advice of any kind.

In a matter of days, a novel decentralized payment method can be seamlessly integrated into your website. GetBlock explains how your business may benefit from adding stablecoins’ support.

Unparalleled volatility of digital assets (cryptocurrencies) is generally assumed as the major obstacle to their adoption by real-world businesses. Here’s why the idea of ‘stable’ cryptocurrency gained enormous traction in 2018-2019.

What Are Stablecoins and How Do They Work?

Stablecoins should be referred to as the cryptocurrencies where the price is designed to be pegged to some real-world asset (fiat currency, exchange-traded commodity and so on). There are stablecoins pegged to the U.S. Dollars (USD), Euros (EUR), Singapore Dollars (SGD), Hong Kond Dollars (HKD), Chinese Yuans (CNY, RMB), Indian Rupees (IDR), Japanese Yens (JPY) and so on.

Some stablecoins are pegged to the price of Gold (XAU), Silver (XAG). Finally, there are algorithmical stablecoins: their supplies are controlled by sophisticated smart-contract-based minting/burning mechanisms.

In a nutshell, a stablecoin represents an agreement between its issuer and its holder. Issuer guarantees that it owns 1 USD (or its liquid equivalent in bonds, stocks) on some bank account and therefore is entitled to create (‘mint’) 1 ‘Synthetic USD’ on some blockchain. Holder believes in this peg and, as such, believes that, say 1 USDT is equal to (roughly) 1 USD.

Top-3 Stablecoins in 2021

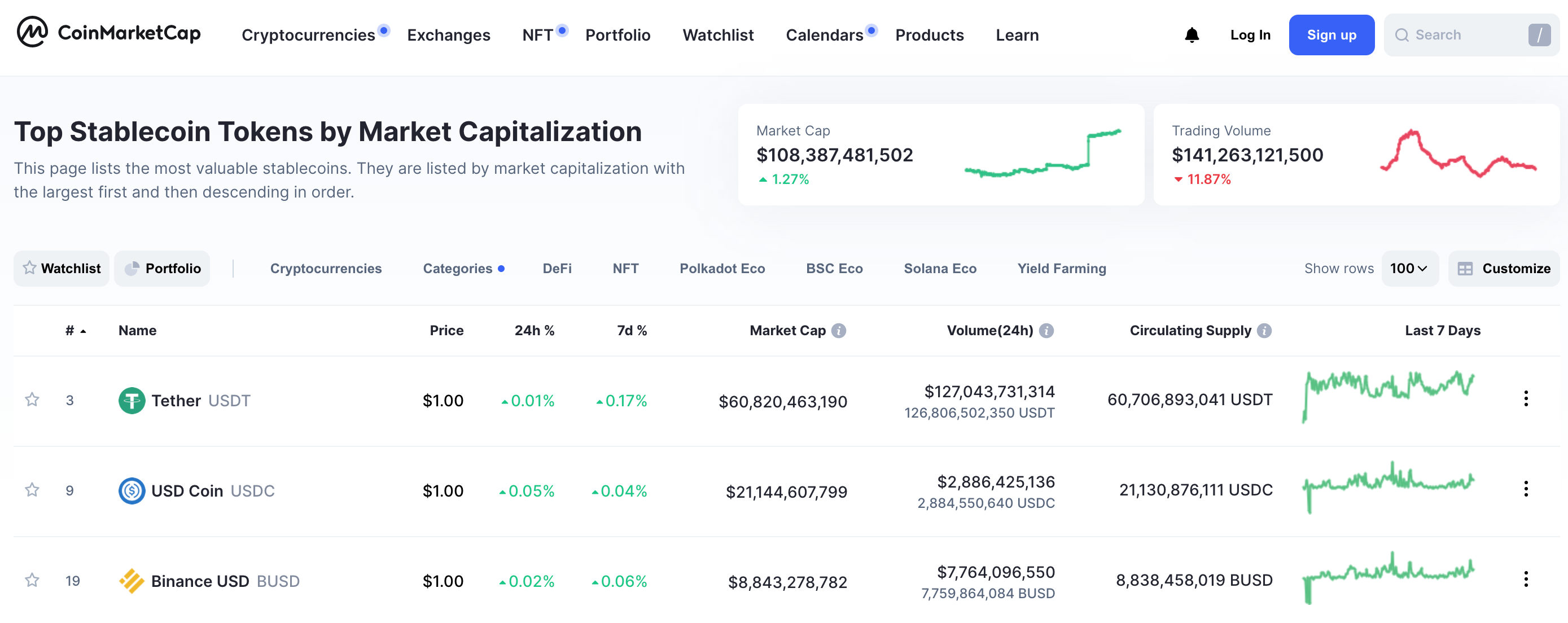

While there’s a plethora of stablecoins available on crypto markets (64 coins by dozens of issues, according to CoinMarketCap ranking), only three products comprise 84 % of net stablecoins supply: the U.S. Dollar Tether (USDT), USD Coin (USDC) and Binance USD (BUSD).

Image by CoinMarketCap

USDT

U.S. Dollar Tether (also USDT or Tether) is the largest stablecoin ever. It retains this status since its inception in 2015. USDT is issued by Tether Limited, the affiliate of top-notch cryptocurrency exchange Bitfinex.

Amidst the ongoing crypto bullrun, Tether increased USDT market cap by more than 1200% in 12 months.

In 2021, Tether settled its years-long legal battle with U.S. regulators that accused its team in market manipulations. Also, in May, 2021, it released a pioneering transparency report to cover the structure of USDT backing.

USDC

USD Coin (USDC) is issued by the U.S.-incorporated Circle. This stablecoin grows rapidly: its supply spiked from $2 bln to $20 bln in less than six months.

USD Coin is the most dangerous rival to Tether (USDT). Interesting fact: the U.S. government used USDC to support Venezuelan opposition.

BUSD

Binace USD (BUSD) is marketed as the official US dollar-pegged stablecoin of Binance. It was introduced in 2019 by a world-leading cryptocurrency exchange Binance. Besides trading, Binance (BNB) utilizes BUSD in rewards programs, staking, and saving instruments.

Binance USD (BUSD) is maintained in collaboration with fintech veterans Paxos. Market capitalization of BUSD exceeded $8,5 bln by printing time.

Stablecoins for Your Business

That said, stablecoins merge the benefits of fiat currency (high liquidity, predictable course) and crypto assets (decentralization, censorship-resistance, low fees).

Once stablecoins are added to the string of payment methods on your website, your customers are able to purchase goods and services with popular crypto assets.

This addition will increase the visibility of your brand and contribute to sales volume due to the intuitive, seamless and low-cost character of stablecoins’ operations.

Integrate Stablecoins with GetBlock

Typically, stablecoins are integrated via the collaboration with fiat on-ramp (e.g. Simplex). However, with this type of integration, your customers are charged with extra third-party commissions. Also, your website will rely on external services vendors while accepting cryptocurrencies.

Activating seamless access to blockchain nodes with GetBlock is a much more advanced alternative for high-performance decentralized applications and marketplaces. Modern stablecoins exist on different blockchains: for instance, USDT coins are minted on eight separate platforms (Ethereum, Tron, EOS and so on).

All three major stablecoins utilize Binance Smart Chain and Ethereum for their operations. As a result, by accessing BSC and ETH nodes via GetBlock, your application receives a reliable and cost-efficient paygate to all major stablecoins systems.

Thus, the need to charge your customers with extra fees and to rely on third-party infrastructure providers is eliminated.