In 2021, initial decentralized exchange (DEX) offerings or IDOs established themselves as the most common form of crowdsale in cryptocurrencies realm. Is this better than ICO?

What is an Initial DEX Offering (IDO)?

Initial decentralized exchange offering (IDO) should be referred to as the form of crypto tokens crowdsale organized through a decentralized (on-chain) platform.

In 2017 when a plethora of initial coin offerings (ICO) attracted no-coiners to the crypto segment, an investor was required to send his/her crypto (typically, Ethers or Bitcoins) to a particular cryptocurrency address. Then, he/she received tokens at a predetermined rate to his/her address on Ethereum.

Normally, raised funds should have fueled the further progress of the ICO project. The largest ICO ever, Eos (EOS) managed to raise $4 bln while some others closed with nine-digit gains.

What made this scheme vulnerable? In a nutshell, token sellers (ICO team) bear almost zero responsibility for the ICO funds. The majority of them failed to deliver on ‘revolutionary’, ‘ground-breaking’, ‘game-changing’ roadmaps and closed in 2018.

Here’s how some ICOs performed during their first 12 months.

Image: http://lifeafterblockchain.com/

Needless to say that some ICOs were scams from the very beginning. Shortly after the ending of tokensale, their teams used to shut down websites, delete social media accounts and leave with investors’ funds. Tokens of these products lost 99,99% of their prices overnight.

So, the ICO became a synonym for blatant investing fraud. Crypto scene definitely needed a more transparent and mature concept.

Why are IDOs so popular?

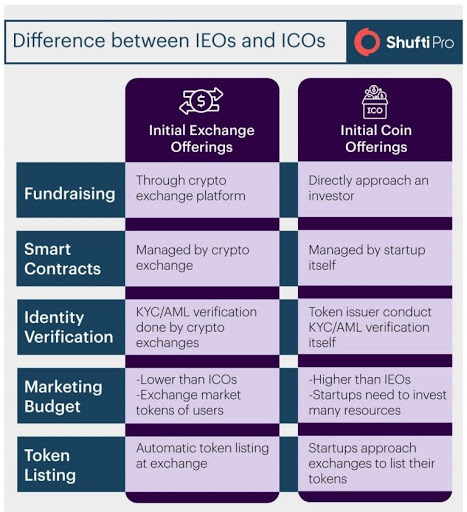

In 2019, leading crypto exchange Binance introduced the scheme of initial exchange offering (IEO). The platform (e.g. Binance) organized ‘due diligence’ checks of the projects seeking for the crowdsale and carried out the fundraising on its behalf. Thus, the IEO platforms became responsible for the projects they ‘list’.

This model was way more comfortable for investors yet too expensive for the teams that seek for investments. Platforms started to charge startups with enormous fees of up to $1,000,000 per campaign. As a result, the IEOs faded away in early 2020.

Initial decentralized exchange offering closely resembles the IEO model. Meanwhile, the whole process of interaction between the investors, product team and IDO platform is organized through the ecosystem of smart contracts. No funds are stored on the platform's side: that’s why the entire procedure is cheaper for the team.

Image by Shufti Pro

Besides lower marketing budget, IDO platforms normally guarantee the listing of project’s tokens on its trading suite. Also, IDO platforms are responsible for AML/KYC verification for all investors. That’s why IDOs can’t be used for money laundering.

There are many IDO platforms across all blockchains that support smart contracts, e.g. Coinist (Ethereum), Polkastarter (Polkadot), BSCPad (Binance Smart Chain), TronPad (Tron) and so on.

How to benefit from IDOs?

Average users can benefit from participating in IDOs by investing funds in IDO tokens. To obtain tokens, crypto holders need to be whitelisted by the platform: to prevent spam registrations some launchpads require applicants to hold a minimum stake of platform’s native tokens.

Due to enormous interest in this segment, IDOs introduced ‘allocations’ (maximum USD-denominated amount of tokens that can be obtained by one user) and randomized lotteries for those interested in investing.

So, to get IDO tokens, you need to register on IDO platform, connect your Metamask or other wallet, sign up for this or that tokensale, buy platforms’s tokens to be included into ‘Tiers’ of potential investors and spread the word about the tokensale in social medias.

Winners of the lottery should transfer their Ethers or Binance Coins to the project's smart contracts to obtain IDO tokens. Normally, the winners are informed by e-mail.

Bonus from GetBlock: Three IDOs’ red flags you should never ignore

Just like many developing segments of crypto investing, the IDO sphere is flooded with scams of all sorts. Here’s your 101 to stay safe in these waters.

Non-existent product

Always check the project before investing. For sure, you don’t need to find ‘second Ethereum’ or ‘Binance killer’ to enjoy good ROI. Meanwhile, if the project has no public codebase while its social media accounts are created yesterday, you should better avoid it.

Shady IDO platform

Do your own research about the platform this particular IDO is launched by. Typically, tracking the history of latest fundraisings (they should be public and legit: many secrets protect many scams) takes minutes but can prevent your portfolio from disappearing.

‘Happiness for everybody, free’

Beware of products where you can invest any amount of crypto without lottery, allocations, whitelisting - just for the registration and sharing in social media. Serious projects will never be interested in your 0.001 ETH - and scammers will.