Top Solana Decentralized Exchanges

Vance Wood

December 4, 2025

10 min read

Solana decentralized exchanges allow users to trade popular tokens without the need to prove their identity, as the protocol’s smart contracts secure all transactions. They also deploy liquidity pools to ensure the availability of tokens to exchange, and users can contribute to them to earn a stable income.

Many of these services offer other tools, such as lending or perpetual trading. And of course, all of them need Solana RPC nodes to work properly.

Here, we’ll explore the best Solana DEXs, analyze them using metrics from the analytics services such as DefiLlama, and see how they differ from each other. Some of them offer unique features, while others are simple to use. Let’s begin.

Top Solana DEXs: List

Here are some examples of Solana DEX platforms:

Jupiter

Raydium

Drift

Meteora

Orca

HumidiFi

GMX

Sanctum

Uniswap

Ondo Finance

Pump.fun DEX

Here, we won’t explore all of them, and we’ll share our metrics so one can understand our reasons to select only the first five projects. For example, HumidiFi is only an early-stage project as of 2025, Sanctum and Ondo Finance are focusing on DeFi and staking features, and Pump.fun operates in a specific memecoin niche. Regarding GMX and Uniswap, while they’re among the largest DEXs, they aren’t specifically designed for Solana—unlike our selected ones.

What is a Solana DEX

We’ll dive into details soon, but before, let’s explore what Solana DEXs are in general.

Building your own Solana project? Contact us and let’s grow together!

Smart contract usage

Every decentralized exchange uses a set of smart contracts to ensure that trades proceed at the market price. Exploring all of them is a complex task, which is clearly beyond the scope of this article, so here we’ll just provide a short list of smart contract examples used by DEXs.

Interested in Solana Web3 development? Read about Solana development tools at GetBlock!

Here are these examples:

Limit order contract: handles swap orders, calculates prices, and records transactions onchain.

Liquidity pool contract: mints liquidity pool (LP) tokens, burns them when liquidity is withdrawn, and distributes rewards.

Router contract: manages transaction fees and calculates the best transaction routes for DEX aggregators.

Other features also deploy various contracts, such as orderbooks for perp trading, oracle contracts for price predictions, and other specific cases. We won’t be diving into the technical details of these protocols, but we will analyze them in separate articles.

Smart contracts ensure user fund security, execute transactions, reward liquidity providers, and track market prices. They maintain DEX platforms truly decentralized and independent, but their vulnerabilities can be exploited by malicious agents, so they require concise and regular audits.

Liquidity pools

To keep the token supply, decentralized exchanges use liquidity pools, where everyone can contribute a portion of their tokens and earn rewards as other users trade these tokens. These rewards are dynamic and depend on the trading activity and token price.

Such pools are created and held by liquidity providers, who deposit their tokens and allow other users to deposit their own, too, sharing rewards. Liquidity providers also get liquidity pool tokens (LP tokens), which they can use in DeFi activities later.

DEX infrastructure

Similar to other blockchain services, decentralized exchanges need RPC infrastructure to work, as they handle thousands or millions of user transactions every day. Each transaction and smart contract execution uses RPC requests to connect to the blockchain and call its methods. Stable RPC infrastructure with low latency is crucial for the DEX's uninterrupted operation.

GetBlock is working to ensure it. Contact us now to know more.

Summary of the best 5 Solana DEXs by GetBlock

Here are our five chosen Solana DEX platforms, with the key metrics and short comments regarding each of them.

DEX | TVL | Market cap | DEX volume (24h) | Comment |

Jupiter | $2.9b | $960 million | $13 billion | Offers a full-scale DeFi ecosystem |

Raydium | $1.5b | $370 million | $650 million | Uses various liquidity pools |

Drift | $1.0b | $114 million | $1 million | Mostly used for perps trading |

Meteora | $730m | $230 million | $700 million | Offers liquidity pool creation tools |

Orca | $390m | $76 million | $500 million | Uses various liquidity pools |

As you can see, metrics can vary greatly and aren't always intuitive. For example, Drift Protocol has a large total value locked (TVL), but its DEX volume is much smaller compared to other platforms. The reason is that Drift positions itself primarily as a perpetual (perp) trading platform, where its volume is only slightly lower than Jupiter’s, the leader in all categories.

Now we’ll focus on why we’ve selected these ones.

Key metrics of the best DEXs

Let’s now compare the metrics we’ve discussed above and explain how they differ and how to apply them.

Total value locked (TVL)

This is the most important metric, as it’s the closest to the real value of the service. It represents the assets locked in the protocol by its users, usually in the DEX’s liquidity pools. The larger it is, the more stable, sustainable, and trusted the protocol is.

Generally, it’s the first metric to understand the real usage and value of the protocol.

Market capitalization

Market capitalization, or market cap for short, is the total market value of the tokens that are traded via the protocol. It can vary greatly depending on the token prices: as the crypto market surges and shrinks, market caps do as well.

This metric can be useful to evaluate the total token supply on the DEX market.

Trading volume

This is the total value of trades made via the decentralized exchange’s interface, and unlike market cap, it’s independent of the token price. It shows the current traders’ activity on the DEX platform.

Thus, it can be used to estimate how actively the protocol’s DEX features are used.

Usability

Last, an important aspect of any service is how easy users can interact with it. Let's look at several notes regarding the user interface of the projects discussed here.

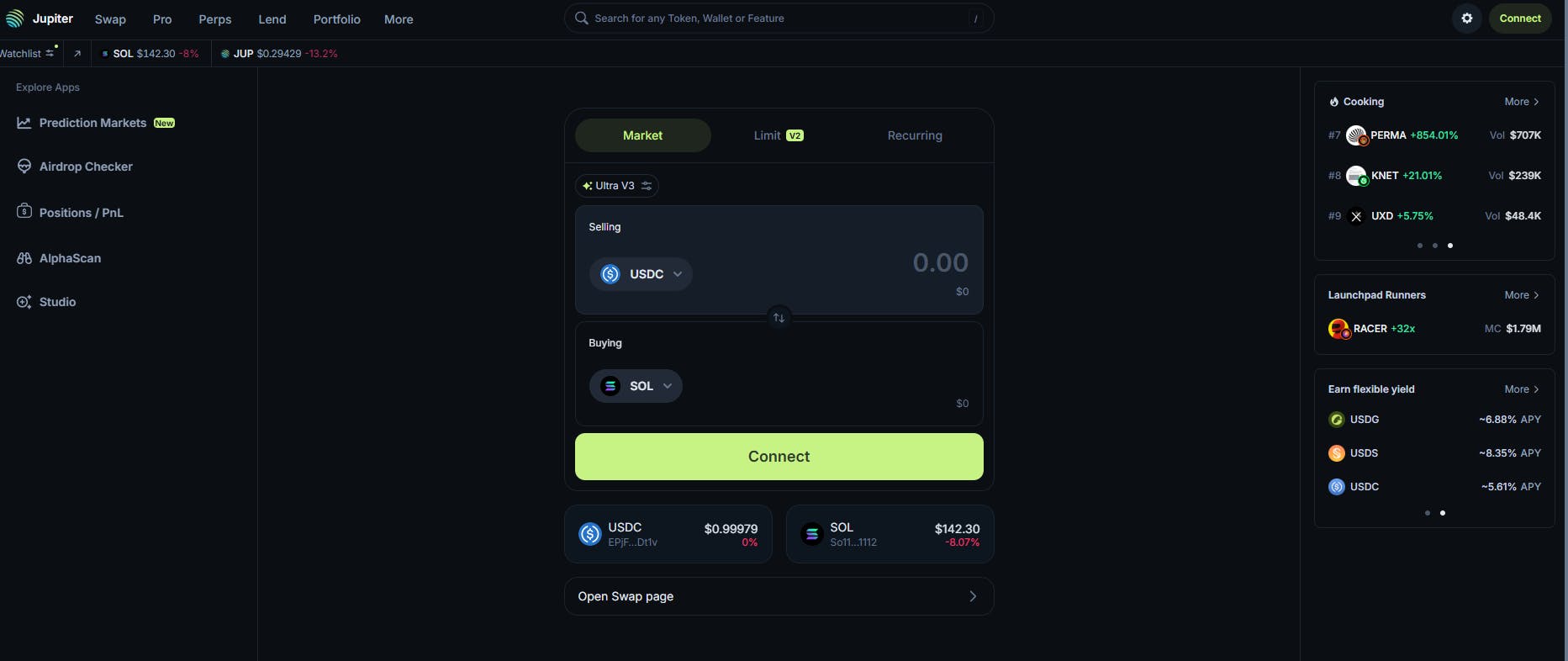

Jupiter has a variety of DeFi tools, each of which can be accessed using its simple menu interface.

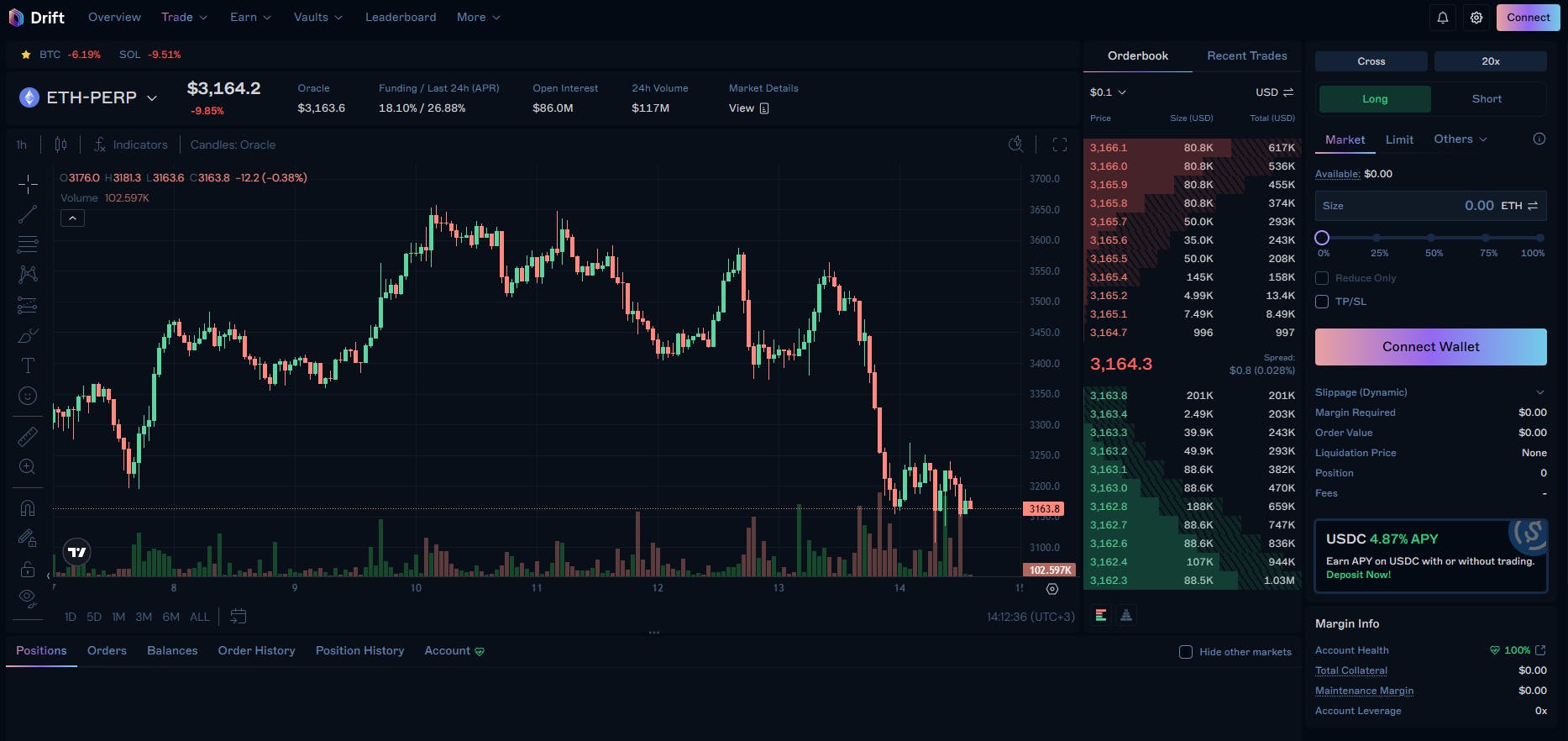

Drift has quite a complex interface with robust price analytics, designed for crypto traders and institutions.

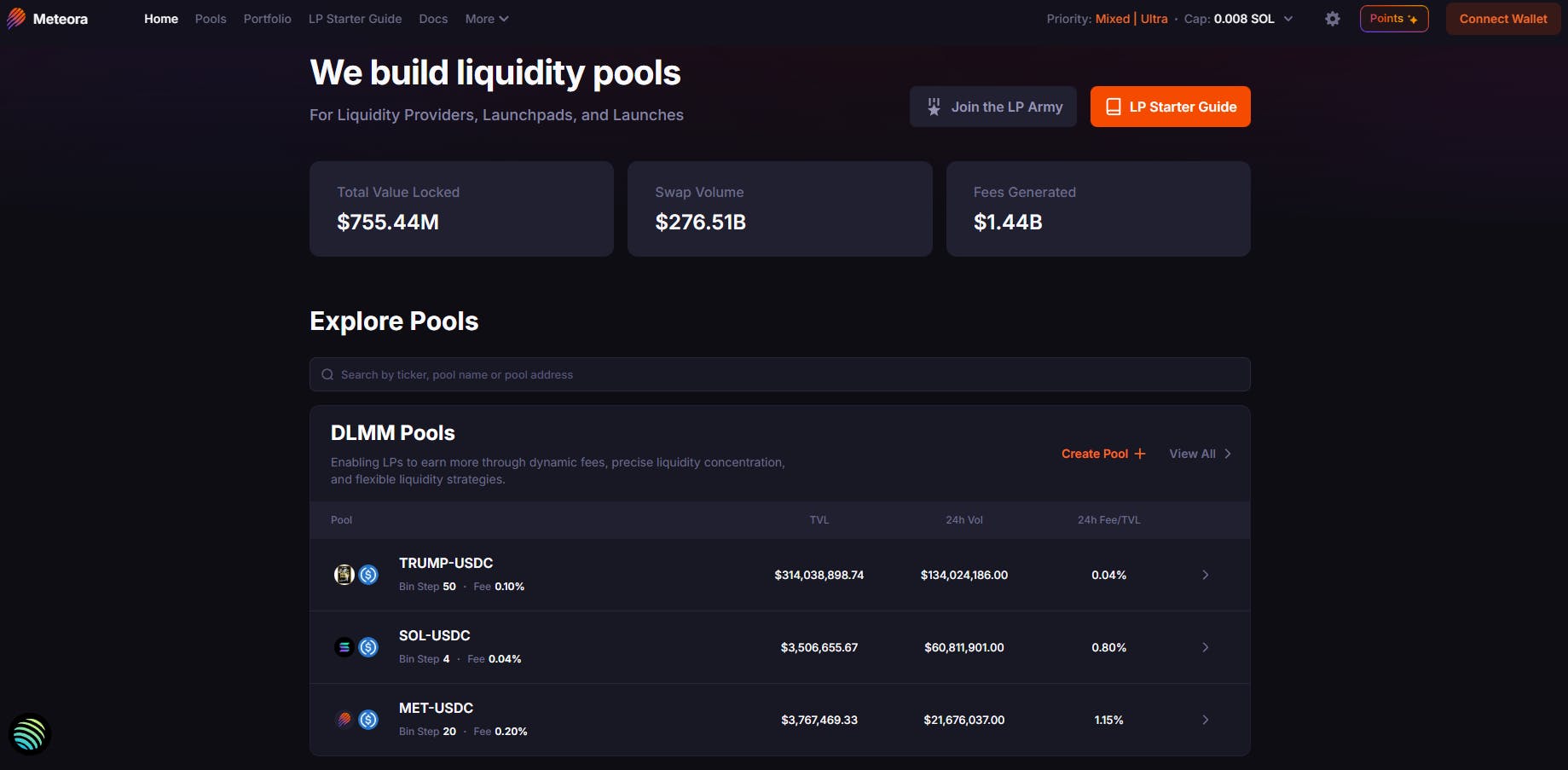

Meteora focuses on liquidity pools, not swaps: users have to add positions to these pools and manage them via portfolio.

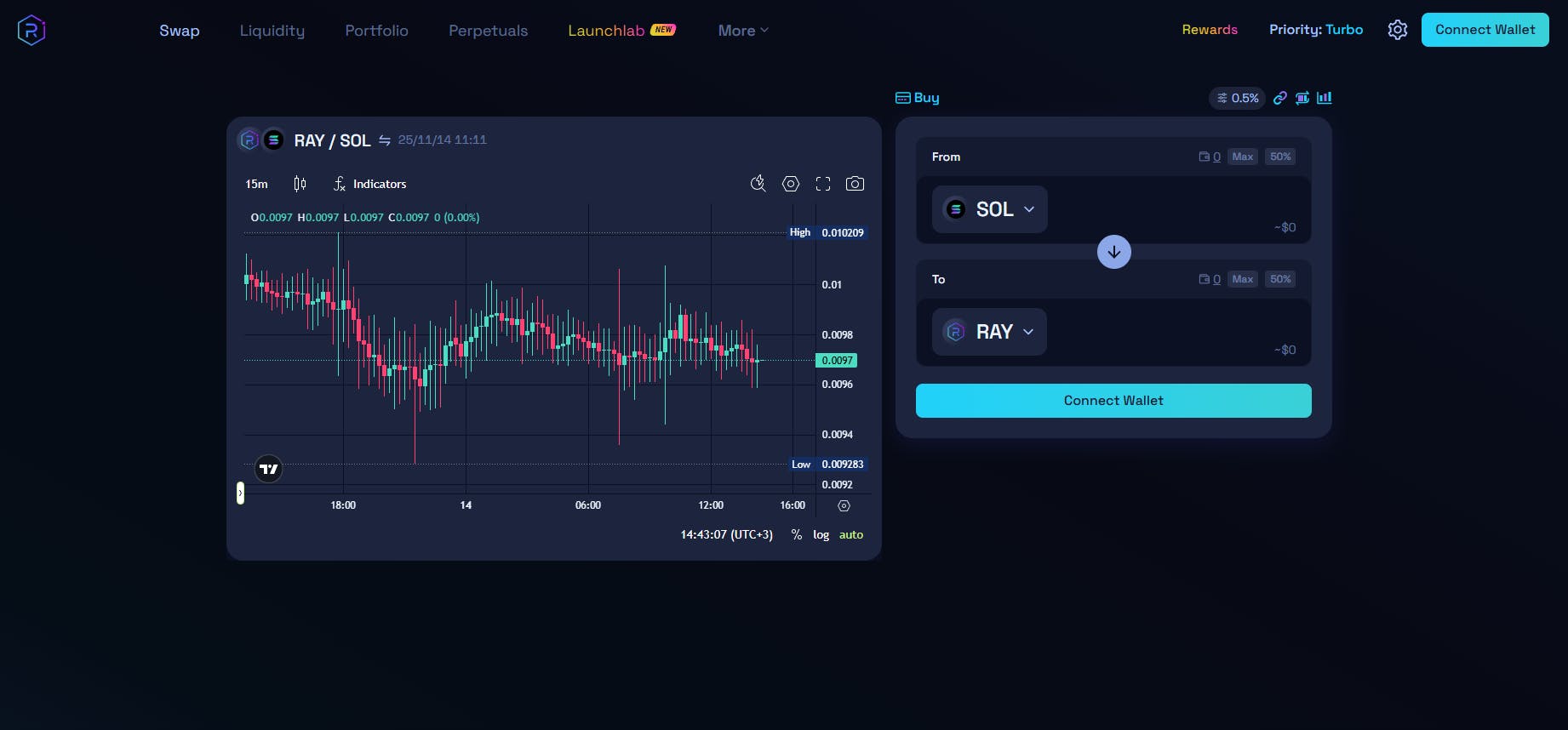

Raydium and Orca have, overall, very simple interfaces, focused on token swap and liquidity pools.

After evaluating metrics, we can dive deeper into each platform.

Snapshots of the best Solana DEXs

Now, we can focus on the five services we’ve selected here. Let’s remind them:

Jupiter

Raydium

Drift

Meteora

Orca

Let’s explore each platform in detail.

Jupiter

Jupiter is the largest and most trending Solana DEX platform—or, more precisely, a DEX liquidity aggregator. It offers a variety of DeFi tools and the largest perp trading service on Solana. Users can swap Solana tokens, trade Bitcoin or Ethereum perpetuals, stake Solana, and lend or borrow assets, all secured with the large TVL.

Source: Jupiter

Raydium

Raydium is another large DEX with a clear and simple interface that tracks asset prices. It also has a variety of liquidity pools to stake tokens, a bridging service to connect with EVM chains, a launchpad for the upcoming hot tokens, and a perpetual trading platform in development.

Source: Raydium

Drift

Drift Protocol offers a variety of DeFi features and is mostly used for perpetual trading. It also offers lending, borrowing, and liquid staking. While it has a Solana token swap interface, similar to other platforms, it’s used much rarely than other features, hence its DEX trading volume is much lower compared to TVL and market cap.

Source: Drift Protocol

Meteora

Meteora has a slightly different interface compared to other DEXs. Instead of focusing on token swapping, it focuses on liquidity pools, where users can contribute their tokens and earn APR as the token prices change. They can track their contributed tokens in their portfolio and change them according to the price changes.

Source: Meteora

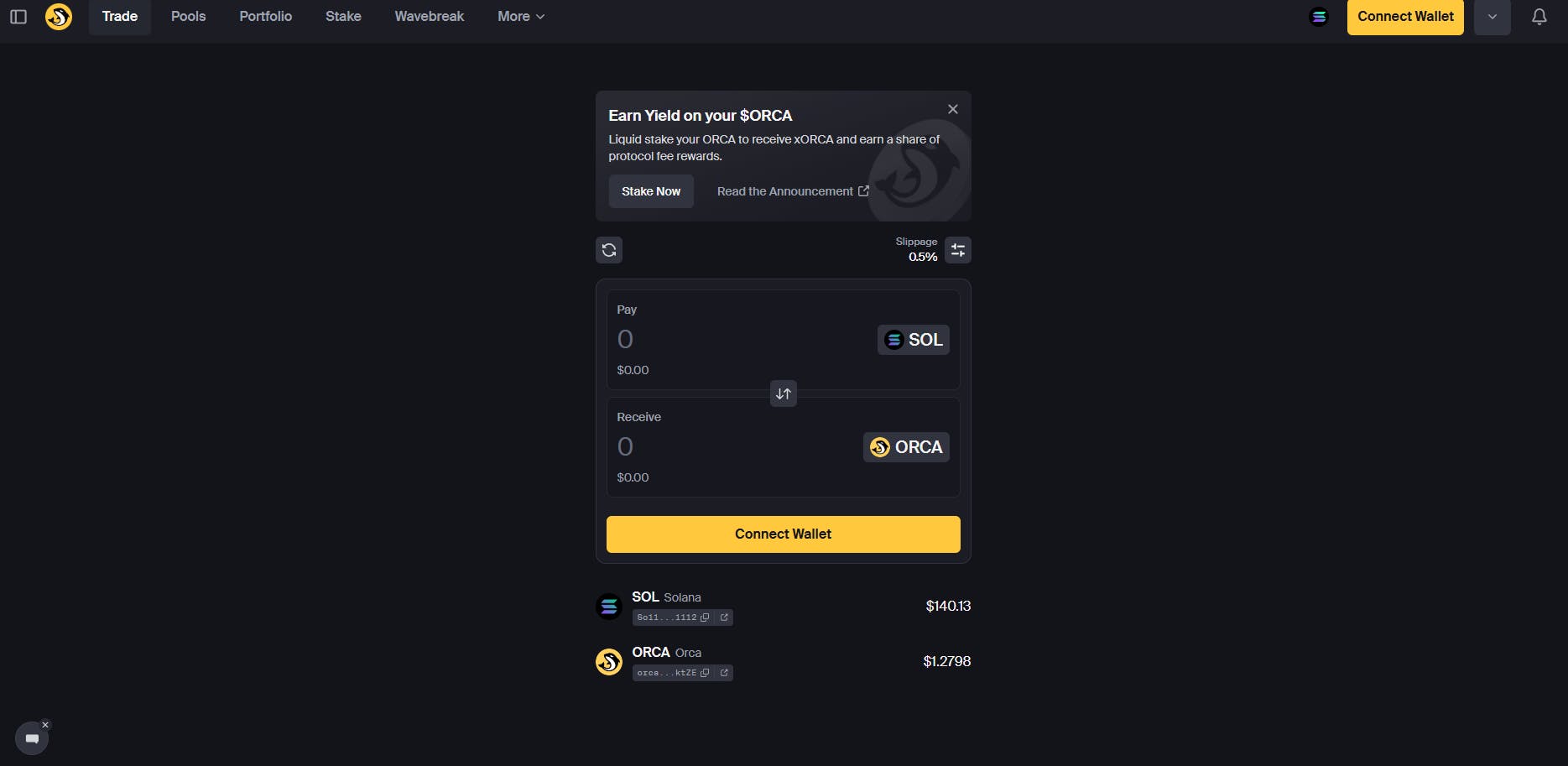

Orca

Orca offers a simple user interface with token swap and liquidity pool features. Users can track their positions and stakes in the portfolio tab. They can also stake SOL to get the platform’s native token and earn staking rewards.

Source: Orca

How to choose a Solana DEX

To wrap up the article and solidify the understanding of Solana DEX platform, here is a quick checklist of what to consider when selecting a platform.

Do you want to trade Solana tokens or use perps to trade a variety of assets?

Do you mostly want to trade or contribute to liquid staking for passive income?

Check the platform’s fees and slippage management to ensure the best value.

Check the platform’s security audit reports and explore its community.

Check the platform’s TVL, liquidity, and overall trading activity.

Thanks for reading—and let’s summarize!

Conclusion: Solana DEX platforms and RPC nodes

To fully realize their features, Solana DEX platforms need a robust SOL RPC infrastructure that can handle high volumes of user requests without slowing or crashing. Their services imply that thousands of users will execute smart contracts and conduct transactions every minute, so a massive infrastructure is required to support that.

With the emergence of perpetual DEXs, new innovative projects, and planned Solana updates, such as Solana Alpenglow, one can expect that the trading volumes will grow. As a result, even more infrastructure will be needed. That’s why services like GetBlock will always be in demand, regardless of the current crypto market situation.

GetBlock is a solution for all Solana services, from small projects to large enterprises. We ensure stability for platforms that must handle numerous blockchain requests and support growing, innovative Web3 projects. Get API key now and use the plan that suits your needs—and scale as you grow!

FAQ

What is a Solana DEX?

Which Solana DEX types exist?

How do I connect a wallet to a Solana DEX?

What fees should I expect on Solana DEXs?

Is KYC required on Solana DEXs?

Popular Posts

June 9, 2021

4 min read

November 9, 2021

5 min read

May 24, 2022

5 min read

March 18, 2021

4 min read