In September 2022, after the “Merge” event was carried out, Ethereum transformed into a Proof of Stake chain: users are now able to stake their ETH and earn annual rewards of approximately 3-6% in exchange for their services. However, there is currently one major downside to Ethereum staking: users cannot withdraw staked ETH. The upcoming Shanghai upgrade set for March is supposedly going to fix this issue.

To escape this potential inconvenience, more and more traders are opting for the liquid staking alternative. What is liquid staking and how do its derivatives work? What are some of the possible ways to benefit from LSDs? Let’s find out.

What is liquid staking?

Liquid staking is a form of benefitting from owning certain cryptocurrencies, which allows users to stake their coins and still continue to use them for trading on decentralized exchanges, like Uniswap. In the traditional variant of staking, users cannot retain this ability, moreover, in many cases their coins have to be staked for a certain period of time. Liquid staking is achieved with the help of a smart contract used to create a derivative of the staked coins, while simultaneously keeping the original coins locked up in the wallet.

Why are liquid staking derivatives (LSDs) good?

Liquid staking is gradually becoming more popular in the DeFi industry, making it a new and innovative way of earning passive income from your crypto assets. This is also a great alternative for crypto enthusiasts to take advantage of the crypto market. For instance, if the price of your staked coins is experiencing an increase, you can form a derivative of your assets and trade it on the decentralized exchange, giving you a higher chance to maximize your possible total revenue.

Another thing that makes liquid staking good is the ability to create diversified portfolios, meaning that traders can stake multiple coins in different wallets and, in addition to that, receive staking rewards, whereas liquidity providers earn trading fees.

What is the Shanghai upgrade?

It’s worth noting that at the time of writing this article staked ETH cannot be withdrawn by users. Ethereum’s upcoming Shanghai Upgrade set for March 2023 (could be delayed) is aiming to add this highly important option and improve the overall staking potential of the Ethereum network.

Speaking of the staking fundamentals, Ethereum is not inferior to other Proof of Stake chains. As of late January 2023, only 14.07% of the total ETH supply is staked, according to the data provided by the Staking Rewards website. This number is significantly lower in comparison to other networks, with the average staking rate being about 60%, or roughly 4x more than Ethereum. For instance, Cardano’s staking ratio is 72.11%; Tron – 44.96%; Polygon – 39.64%; and BNB Chain – 96.63%. The reason for such a poor performance is the network’s inability to withdraw staked ETH and the lack of knowledge of when it is going to be possible.

Besides this, the Shanghai upgrade is aiming to implement other useful features, such as increasing the number of transactions to be processed in blocks; allowing clients with no requirement to store the entire blockchain state to participate in the blockchain activities; boosting rewards for processed gas; reducing the unstaking time to 27 hours, and so on.

Coming back to the purpose of liquid staking, it is designed to solve current staking issues by creating a derivative of a user’s Ethereum stake and further representing it on their behalf in various DeFi applications. These liquid staking derivatives (LSDs) are therefore ERC-20 tokens.

What are the best liquid staking protocols?

Now let’s take a brief look at some of the most popular liquid staking protocols: Lido Finance, Rocket Pool, and Frax Finance.

Lido Finance

Lido Finance undoubtedly dominates the market as it was one of the initial platforms developed in 2020. Lido Finance played a huge role in popularizing liquid staking. The protocol works by enabling ETH deposits via Lido and receiving stETH back. This LSD can be used in other DeFi applications. Also, users can hold it to generate staking rewards in the form of stETH.

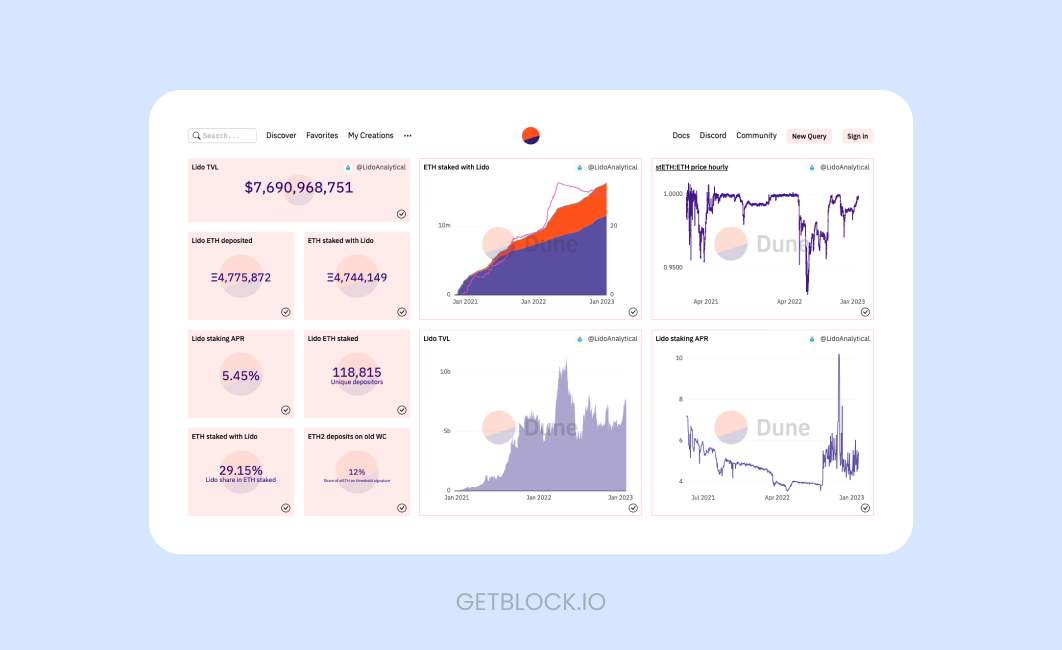

According to Lido’s analytics on Dune, the protocol currently holds almost $7.7 billion locked-in value and close to a 30% share in all ETH staked. Not too long ago, Lido also came out with a wrapped version of staked ETH called wstETH, which allows for seamless integration within the DeFi space, including such platforms such MakerDAO and UniSwap, and grows in value over time.

What’s also important is that Lido Finance takes a 10% cut on all of the ETH stalking rewards and divides it between node operators and the DAO treasury. Besides, Lido utilizes its native token $LDO to perform lending and borrowing operations.

Rocket Pool

Next on our list is Rocket Pool. This is the second-largest liquidity provider, with the difference between Rocket Pool and Lido Finance being the decentralized nature of the former. In Rocket Pool anyone can become a node operator as long as they have enough capital.

Via Rocket Pool you can stake even little amounts of 0.01 ETH and receive rETH back immediately. The commission on staking varies from 5 to 20% depending on the node operator. According to DeFiLlama, the current Rocket Pool’s total value locked is over $923.1 million.

In order for Rocket Pool to create a new validator (also known as node operator), a minimum of 16 ETH is required for a lock-up. Next, this is coupled with 16 ETH taken from the staking pool, and a validator is created. Node operators receive Rocket Pool’s native token RPL as rewards on top of their staking yield, which helps to earn higher revenue. In the future, the required amount to become a validator is set to decrease, thus the entry barrier will be easier to overcome.

Frax Finance

Initially a fractional algorithmic stablecoin called FRAX, Frax Finance is now also a growing liquid staking provider. The system has introduced two separate tokens: frxETH (wrapped Frax Ether) and sfrxETH (Staked Frax Ether). Lately, Frax Finance is becoming more recognized among crypto users as its returns of 6-10% in ETH are attracting many enthusiasts.

One of the potential downsides of Frax is that the node operators are controlled by the platform’s team, which could pose centralized risks.

Related: Learn more about algorithmic stablecoins

Final thoughts

Liquid staking is still a relatively new industry with its full potential yet to be discovered. With the upcoming implementation of the Shanghai Upgrade and possible regulating laws imposed in the future, the situation in the market may be subject to change. For now, however, using liquid staking derivatives (LSDs) could be a good option for crypto enthusiasts to earn rewards from staking Ethereum. Please note that before participating in any staking activities, you are strongly advised to do your own research.