Balancer Protocol by Balancer Labs perfectly reflects multiple aspects of what made 2020 DeFi Summer so crazy. Cross-chain approach, a plethora of products under Balancer umbrella, airdrops and surprising integrations: here’s what makes Balancer (BAL) one of the top DeFis while the competition in this segment remains really savage.

From inception to explosion: Balancer in 2018-2020

Balancer (BAL) protocol that addresses use-cases of ‘programmable liquidity’ was initially launched as an R&D product of BlockScience firm in 2018. Fernando Martinelli and Mike McDonald were its founders.

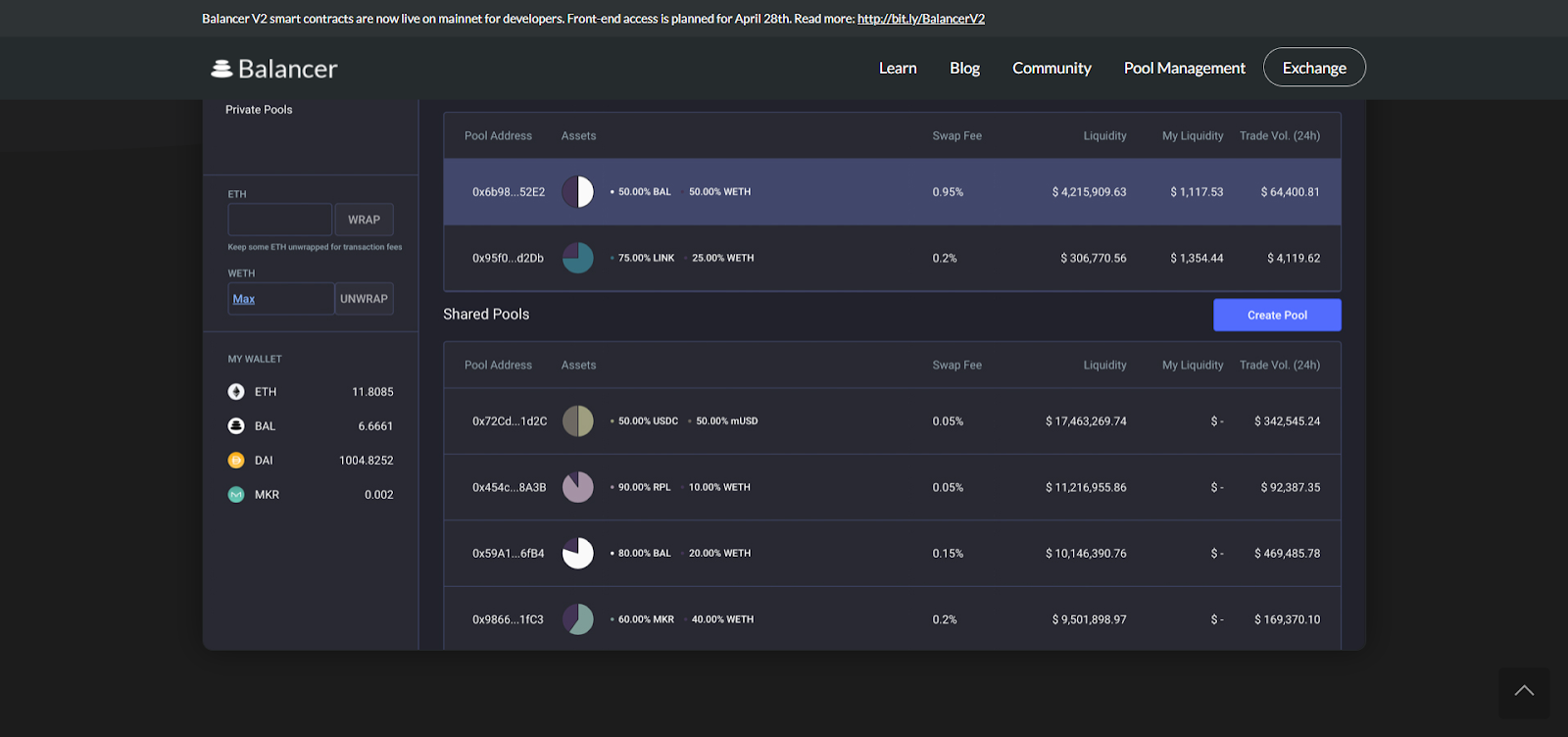

Core idea of Balancer (BAL) seemed revolutionary from the very beginning. Its team was tasked with the creation of a technical framework for turning every crypto portfolio into ‘yield farming’ instrument. Namely, it was designed to allow users to bring liquidity to Balancer’s pools in exchange for LP rewards calculated in BAL tokens.

Say, you hold 8 tokens in your portfolio. Balancer’s mechanisms allow to ‘lock’ all of them into corresponding pools and enjoy periodical rewards.

If the required pool doesn’t exist, users can launch it in a couple of clicks. So, Balancer (BAL) ensures previously unseen freedom for ‘yield farming’ strategies

This concept was appreciated by investors: Balancer Labs raised $3M from iconic crypto-focused VC veterans Accomplice, Placeholder, CoinFund, and Inflection.

Balancer breaks in DeFi euphoria

In Q1, 2020, when DeFi insanity started gaining its steam, Balancer unveiled its first mainnet iteration. Summarizing its experience, Balancer (BAL) team called it ‘key building block in DeFi’ to reflect its robustness, technology advance and rich functionality.

Balancer (BAL) established a full-stack DeFi ecosystem under its umbrella. To start with, it deployed one of the first launchpads for initial DEX offerings (IDOs), i.e. decentralized tokensales. Then, its liquidity mining tools ensured profitable strategies for holders of multiple tokens.

‘DeFi ETP’, an analogue of exchange-traded fund, is one more killing feature of Balancer (BAL) ecosystem. First-ever index of DeFi blue chips was released in Balancer V1 and included YFI, COMP, UNI, AAVE, SNX, MKR, SUSHI and UMA tokens.

Also, Balancer served as a technical basis for many other DeFi protocols, such as bZx and Aave Protocol (AAVE).

Balancer V2: updated contracts, ‘once-in-a-lifetime’ partnership, new AMM

In February, 2021, Balancer team dropped a bombshell by releasing a roadmap for its second iteration, Balancer V2. The most crucial update reconsidered the design of automated market making on Balancer. In Balancer V2, AMM logic is separated from funds management: AMM operations are executed by dedicated smart contracts hierarchy.

Also, Balancer V2 introduced customized AMM instruments: teams were invited to deploy their own strategies and experiment with them. Reshaped structure of operations guarantees gas efficiency and more profitable ‘yield farming’.

Asset Managers, third-party smart contracts capable to manage the assets in vaults are one more advanced technological feature of Balancer V2.

Balancer V2 smart contracts were deployed in mid-April, 2021. Interface for Balancer V2 is ready and undergo stress-tests right now to be unveiled in early May, 2021.

Finally, Balancer (BAL) partnered Ethereum (ETH) veterans Gnosis to build a new decentralized exchange instrument, Balancer-Gnosis Protocol (BGP). It will pioneer the trading between Ethereum (ETH) assets protected from ‘dark forest’ manipulations with Ethereum (ETH) mempool.

In a nutshell, it will eliminate the opportunities for malicious front-running based on transactions speed arbitrage.

As a result, Balancer (BAL) remains the leader of DeFi innovations in terms of liquidity, technology, and development progress prospects.