Please, note that any information provided below is for informational purposes only and should not be treated as investment or financial advice of any kind.

The level seems to hold and BTC is probably gonna reach new heights in the future. All altcoins are also booming. Why everyone is so crazy about Bitcoin right now, who buys it and why nobody cared about a year ago? Let’s see.

There are several main explanations for this surge. The simplest and most obvious explanation is the end of the bear market for the whole crypto industry. All people that wanted to sell, sold their tokens and forgot about crypto. The new bull cycle has begun.

But another explanation isn’t so simple and requires a more detailed analysis. It’s not a secret that Central Banks around the world print money like there’s no tomorrow. The US is an excellent example of such a policy – in 2020 the USA issued $3 trillion which is almost ⅕ of all dollars ever created. The situation in the European Union is similar – they printed around €1 trillion. What is the outcome of this policy? This money isn’t backed by anything, it’s not something that has any value, because the GDP of these countries doesn’t increase, so if we take the US as an example, it’s basically taking 20 cents per dollar out of the pocket of every dollar holder. The inner value of fiat currencies is heavily tied to economic productivity as each unit of currency can be exchanged for goods and services, thus when the economy doesn’t grow or, even worse, declines, then printing more money means diluting the value of the existing money supply, it leads to inflation. Where does all this money go? It goes straight to markets. The primary objective of all central banks is to save financial markets from collapse, to prevent problems on the debt market with governmental debt, but a lot of this money also goes to stocks, precious metals and other assets, including cryptocurrencies. All experienced investors understand that it’s not the nominal value of their assets climbing up, it’s the value of money going down. Previously the only way to protect yourself from inflation was buying gold and other precious metals. Now investors can buy Bitcoin.

Bitcoin going mainstream?

Bitcoin is becoming a mainstream currency in many ways. Finally, it started to draw the attention of institutions, high-net investors and public companies. All of them buy Bitcoin – charts show that the amount of BTC on exchanges has drastically decreased while the price of the asset increases. Institutions buy Bitcoin to hold it long-term, and the demand is higher than the supply. It’s the classic deflationary model that all Bitcoin evangelists were talking about years ago.

According to a survey conducted by Fidelity Investments last year, 36% of financial institutions in the US and Europe own crypto or derivatives. Even pension funds have plans to join the party. Fidelity Investments currently holds 3% of the total BTC supply for its clients. More and more companies join the trend – Microstrategy, one of the leading business intelligence public companies, bought more than $1 billion worth of Bitcoin in 2020, at the average price of $15,964 per one coin. Currently, they hold 70,470 BTC, which amounts to $3.312 billion at the time of writing. Tesla is yet another public company, which recently sent Bitcoin to the moon by submitting a 10-K SEC filing with a statement of $1.5 billion worth of Bitcoin purchase in January 2021. Their profit in 2020 was $721 million and they have already gained more than $500 million as BTC surged from $39,000 to $48,000.

More to come

None of the largest banks in the world works yet with crypto. The first one to try it is Bank of New York Mellon, one of the best private banks in the US, which now will start providing BTC custody and transfer services for its clients. It is to be expected that more large banks will try the same because they still like making money. Bakkt, one of the largest institutional exchanges, expects that the market capitalization of the crypto industry, including blockchain-based gift cards, loyalty points, in-game assets and cryptocurrencies, could grow to $5.1 trillion by 2025. That means that there’s still a lot of room to grow for every asset, including Bitcoin. There’s no doubt that it won’t be a parabolic growth. We’ll probably see another bear market next years, but despite all these future ups and downs, it seems that Bitcoin has already earned its place as a worthy asset, and the blockchain industry is slowly merging with the general fintech industry, so it’s here to stay for a long time.

How to set up the Bitcoin node with GetBlock

GetBlock is a service that provides a simple API connection to full nodes from over 40 leading blockchain platforms, including Bitcoin (BTC). Our users can connect the BTC nodes to their application using JSON-RPC and REST API methods.

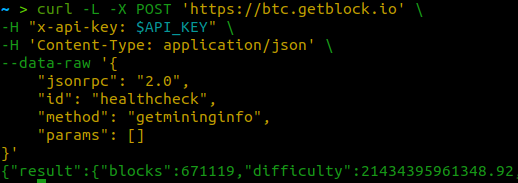

Simply register an account, get a personal API key and start building apps! Here is an example of sending the request to the BTC node:

Now that you’ve started issuing requests, your dashboard will start gathering the info on the BTC node performance and API usage.

Visit our developer documentation to explore the ways of interaction with the GetBlock nodes.