Best Perp DEX Platforms: A New Market Trend?

Vance Wood

October 28, 2025

18 min read

While blockchain technology ensures privacy and security, most crypto trading platforms remain centralized and require user identity data (known as KYC) for compliance. With the rise of the perpetual contract (perp) approach, which uses the blockchain itself to secure orders, the situation is changing.

Here, we’ll explore how perps work, which Web3 projects use them, and how they transform asset trading. Eventually, every Web3 project needs RPC infrastructure—so it’s in our interest to explore them all.

Top perp DEXs in 2025: Introductory overview

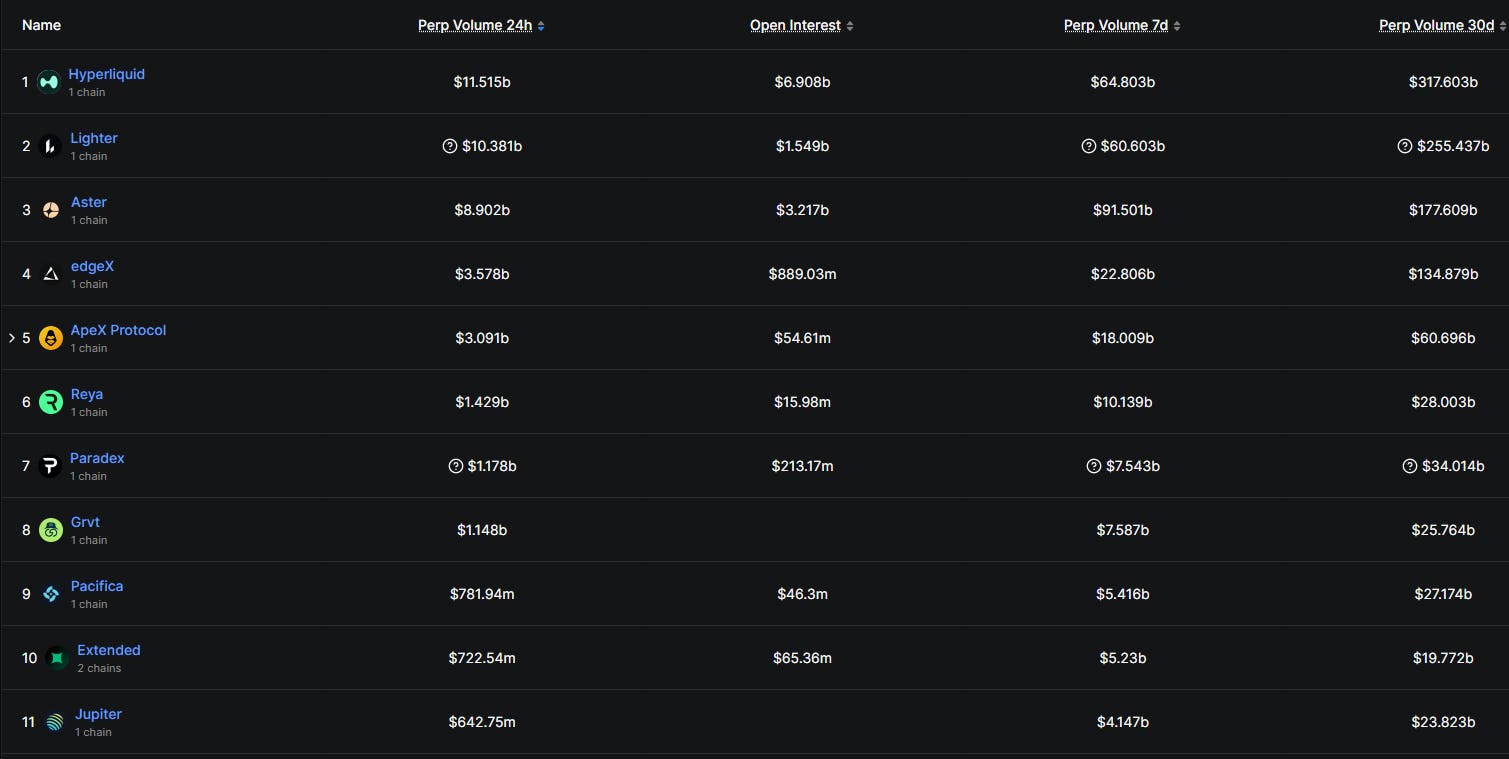

Before diving into how perpetual contracts work, let’s overview the six perp DEXs presented here, with approximate daily trading volume in October 2025.

Perp DEX | Chain | Work principle | Volume |

Hyperliquid | Separate L1 (HyperEVM) | Onchain orderbook on a separate L1 chain | $10 billion |

Aster | BSC, Arbitrum, Ethereum, Solana | Cross-chain aggregation liquidity pools | $10 billion |

Lighter | Separate Ethereum L2 | Onchain orderbook | $10 billion |

edgeX | Separate Ethereum L2 | Onchain orderbook Liquidity pools | $4 billion |

Paradex | Separate Ethereum L2 | Onchain orderbook | $1 billion |

Jupiter | Solana | Hybrid AMM | $0.5 billion |

To compare, the largest centralized exchange, Binance, has a daily trading volume of about $30 billion, which is the absolute record. As one can see, daily trading volumes of the largest perp DEXs are coming closer to this value. They become significant market players that allow users to trade without KYC or geographical restrictions.

Source: DefiLlama

Let’s explore the underlying mechanism of their functionalities.

Perpetual contracts: Trading without KYC

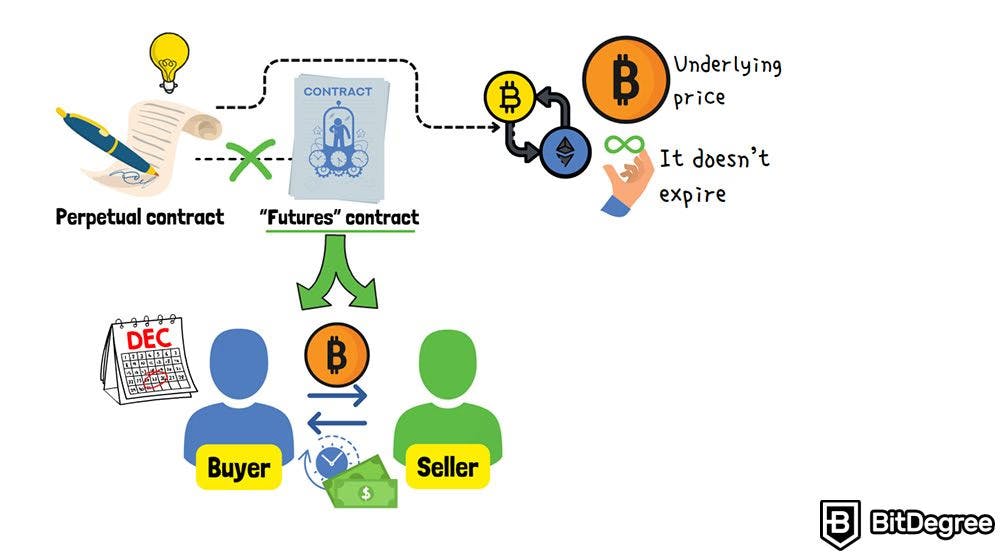

Perpetuals, or perps for short, are similar to futures contracts, which are actively traded on various platforms. Each perp is an agreement between a buyer and seller about the asset price, and it allows them to earn based on the price difference, which is calculated every few hours.

Being secured by the blockchain, they don’t require intermediaries and are executed automatically.

Source: BitDegree

Every perp consists of:

entry price

position size

leverage multiplier

collateral amount

Let’s now explore how perpetual contracts are created, used, and realized on various platforms.

How perps are used

Perpetual contracts are secured by collateral, ensure funding according to the spot market price, and are liquidated based on the maintenance threshold. Let’s look closer.

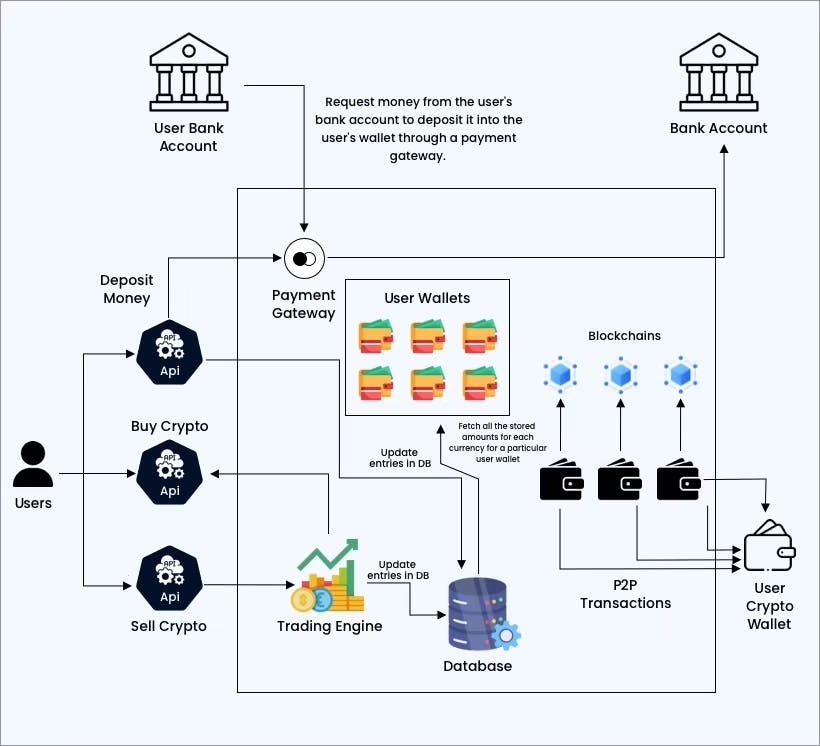

Perps use collaterals, usually in the form of a stablecoin on a taken chain, to secure open positions. To begin, a trader deposits collateral into the wallet connected to the platform.

A trader opens a long or short position, expecting the price to go up and down, respectively. The position is recorded to a perp contract, which acts similarly to the spot position on CEXs, and then submitted to the blockchain.

The funding rate depends on the market price fluctuations and is calculated over a period of a few hours. If the price goes up, long positions are paid, while short ones undergo losses, and vice versa.

If the trader’s losses exceed the threshold, the position is liquidated to prevent future losses and debts. A trader can also close the position at any time, taking profits or stopping losses.

Basically, perpetual contracts allow users to trade different assets without actually holding them, using collateral. Let’s now explore how this mechanism is realized.

How do perp DEXs work

There are several approaches to realizing perpetual contracts onchain. Some of them create their own L1 or L2 chains that record all contracts as a decentralized orderbook. Others rely on liquidity pools, where users deposit their assets. Before proceeding, let’s examine these approaches in more detail.

Fully onchain orderbook: A separate L1 or L2 that records perpetual contracts, which ensures robust performance but requires separate infrastructure.

Liquidity pool model (LP): Relies on staked assets, deposited by liquidity providers, to fulfill trading orders.

Hybrid automated market maker (AMM): Uses price oracles and virtual liquidity to fulfill orders, with backstop liquidity providers to secure positions.

These three approaches can be combined to reach the best results for traders: fast order execution and low gas fees. Each of them has its pros and cons, ranging from the complexities of realization to security risks, and every platform reviewed here addresses these issues in its own way.

Comparison with CEXs

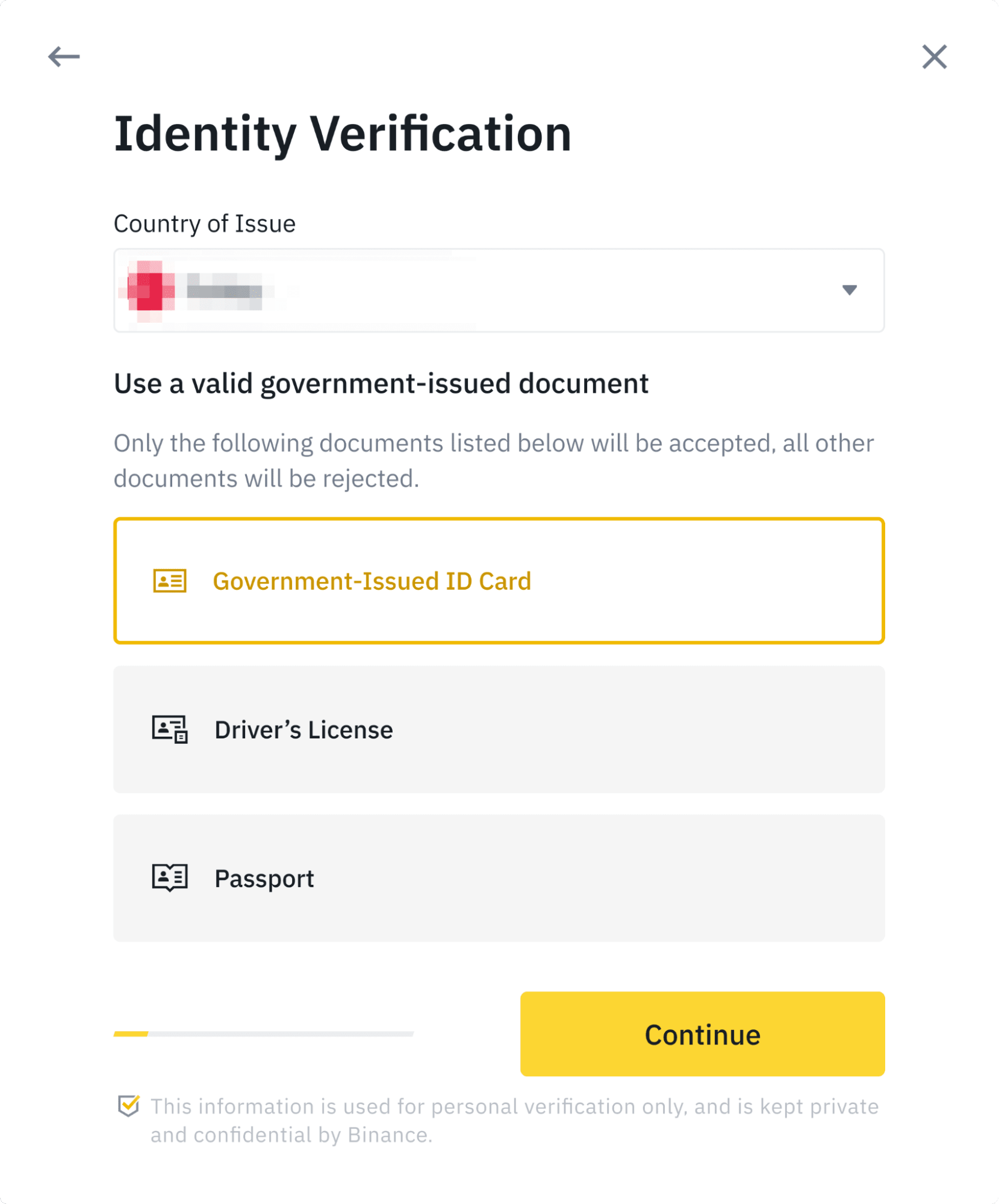

Centralized crypto exchanges (CEXs), like Binance and Coinbase, are in many ways similar to Web2 applications and old-fashioned trading brokers.

They protect user funds with their own custody and keep crypto on their accounts. Consequently, they require KYC (Know Your Customer), and all CEX users must submit their IDs before they can use the platform fully.

Source: Binance

There are several consequences of that:

User funds are protected by CEX custody and can be compensated, but this makes users overreliant and dependent on the platform

As CEX records users’ personal information, it can be breached; additionally, CEXs can deny service to users with specific citizenships or locations

While CEXs provide a familiar user interface and protect user crypto, they have all the drawbacks of centralized platforms. There are cases of them blocking user accounts and denying access to funds due to various reasons, such as international sanctions or suspicious activities. In some cases, it can be justified, but potentially, everyone can suffer from that.

As one can see, centralized exchanges basically have full control over the users’ funds

Perp DEXs don’t use KYC and don’t require users to transfer funds to their accounts. They don’t need identity verification, as user positions are already secured by the blockchain. To use perp DEX platforms, users connect their wallets and use their own assets, so the platform cannot suspend them.

Advantages and potential issues of perp DEXs

In many ways, perp DEXs represent significant progress in blockchain technology. They allow users to trade without sharing their personal information or relying on external custodians to manage their funds.

No KYC or any other personal data sharing

No geography or country restrictions can be applied

All user funds are self-owned and non-custodial

Can be easily integrated with other dApps

Therefore, their users can trade assets, participate in market making, and take advantage of price fluctuations without the restrictions of centralized platforms.

Potential drawbacks and issues

Some centralized exchanges have started to offer various DEX functionalities, highlighting their importance and potential in the blockchain market. However, it’s essential to understand the possible drawbacks, as knowing them is crucial for the technology to develop.

Smart contract vulnerabilities can cause losses and must be audited.

Oracle price manipulations can lead to wrong liquidations and losses.

Funding rate volatilities can undermine the benefits of long-term positions.

Liquidation risks can be high, especially with high leverage.

Unlike CEXs, where user accounts are secured with large custody funds, perpetual DEXs rely only on smart contracts and liquidity pools and have all their vulnerabilities. Still, the technology is constantly evolving, users learn how to utilize it and secure themselves, and all these issues mentioned above can eventually be solved.

Examples of the best perp DEXs

Now, we can focus on the six products presented here. They include:

Hyperliquid

Aster

Lighter

edgeX

Paradex

Jupiter

Let’s dive deeper into each of them.

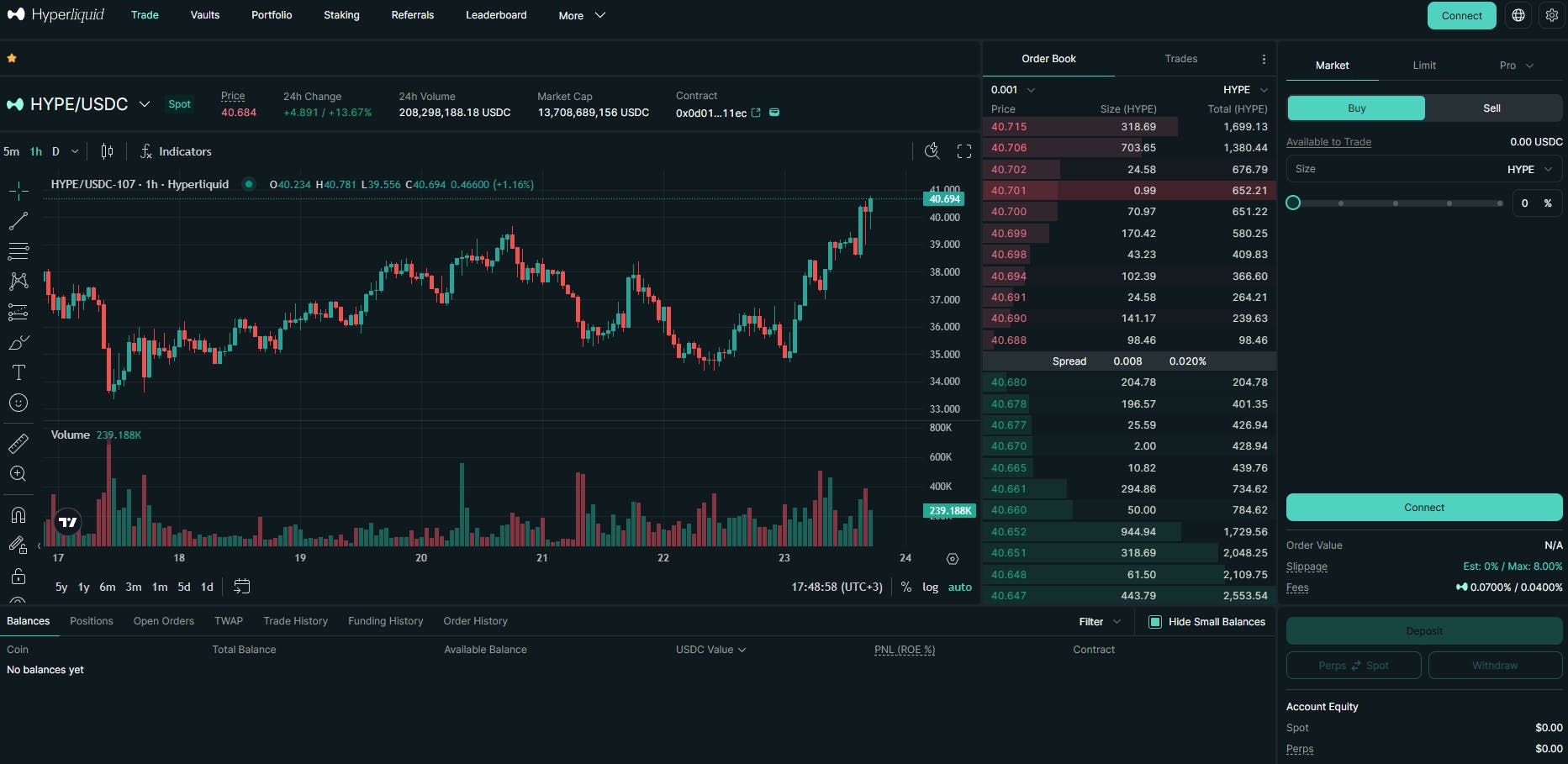

Hyperliquid

Hyperliquid is one of the largest perp DEXs, whose trading volumes are comparable with many CEXs. It uses its own EVM-compatible L1 (HyperEVM) to record and execute perpetual contracts, ensuring high stability and security. It also supports smart contracts and can be used to develop separate dApps. Another component, HyperCore, is an order processing engine that matches transactions using a price oracle and records them into the blockchain.

Did you know that GetBlock offers high-quality dedicated HyperEVM nodes for traders and developers? Contact us to know more!

Source: Hyperliquid

Compared to other platforms, Hyperliquid has its own well-elaborated and dedicated chain infrastructure, where all user orders are recorded. It tracks the asset prices and ensures that orders are executed fast and correctly.

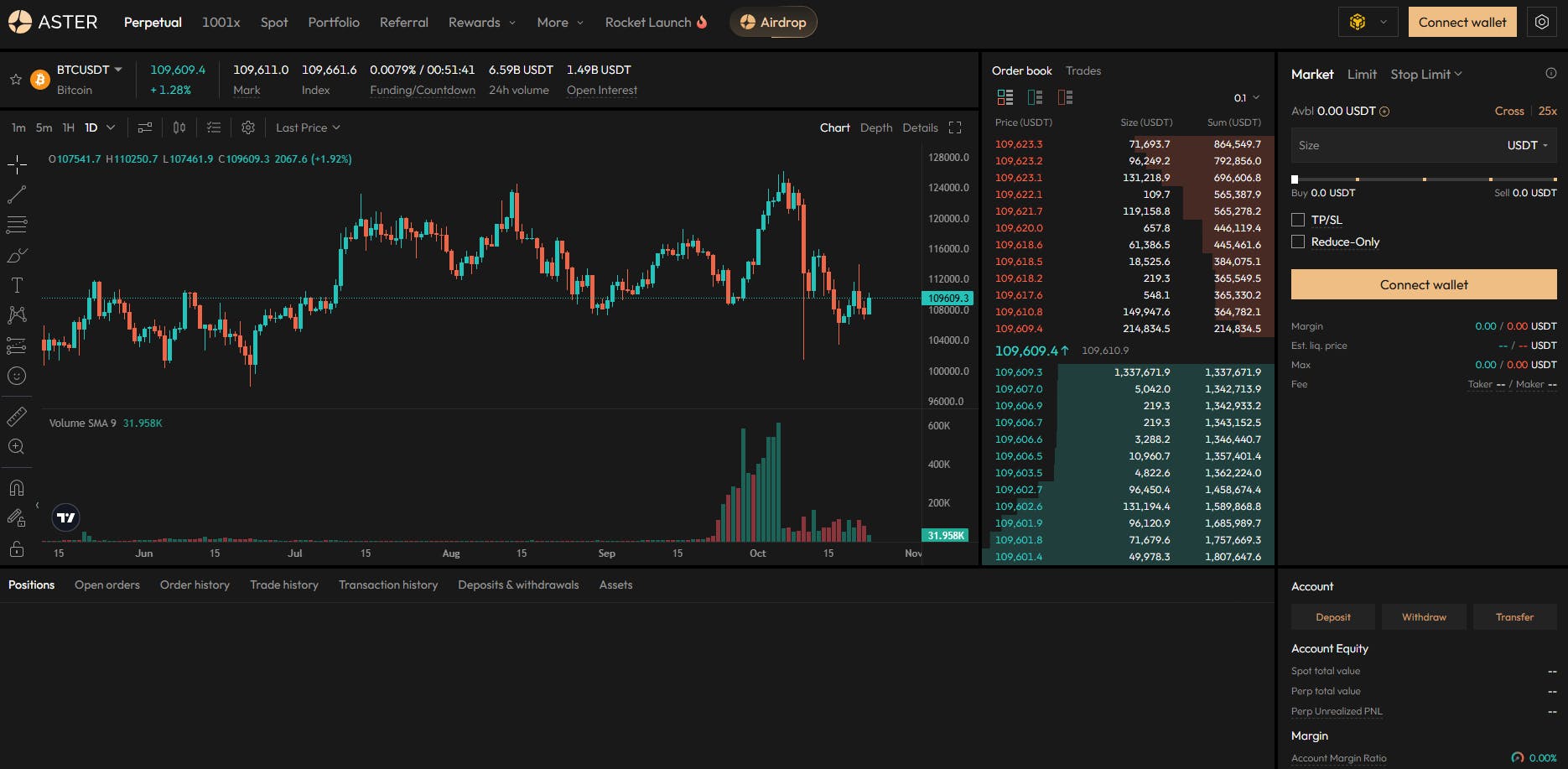

Aster

https://www.asterdex.com/en/futures/v1/

Aster is a decentralized exchange that employs cross-chain liquidity pools to support Ethereum, Solana, BSC, and Arbitrum users. They can contribute funds to these pools, earn APYs, and ensure that traders’ positions are secured. As a result, the whole ecosystem remains decentralized.

Source: Aster

While Aster has no separate L1 or L2 chains to support its orderbook, it gains an advantage with its cross-chain liquidity approach, allowing users to stake assets on different chains. They earn a stable income, and Aster users enjoy liquidity for their trading operations. The project’s success is highlighted by its rapid trading volume growth in 2025.

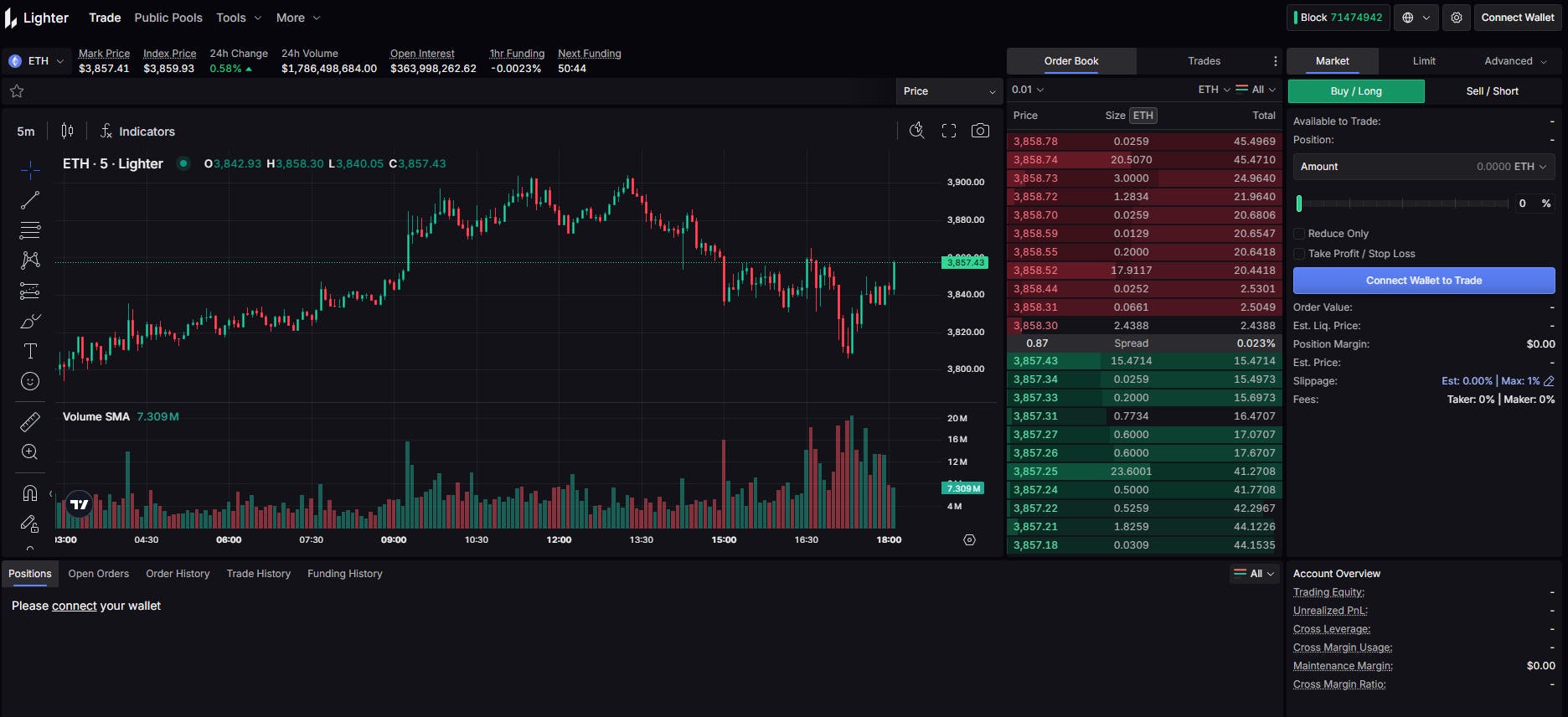

Lighter

Lighter uses a custom ZK-based Ethereum L2 for an onchain orderbook. It uses market data to calculate prices for perpetuals and generates ZK proofs, which are then recorded to Ethereum, ensuring high efficiency without large infrastructure expenses.

Source: Lighter

Its primary advantage is in very low fees: basically, it charges no taker or maker fees, but supports premium accounts that pay it, in exchange for lower latencies and additional rewards. Lighter is among the fastest-growing perpetual DEXs, which highlights its success.

edgeX

Similar to Lighter, edgeX uses a custom Ethereum L2, but also deploys a built-in liquidity provision engine named eStrategy. Users can lock their funds here, earning stable APYs and ensuring liquidity for traders.

Source: edgeX

Therefore, edgeX builds a full-scale decentralized trading ecosystem, with secured user funds for liquidity and an automated L2 orderbook for quick, secure trading.

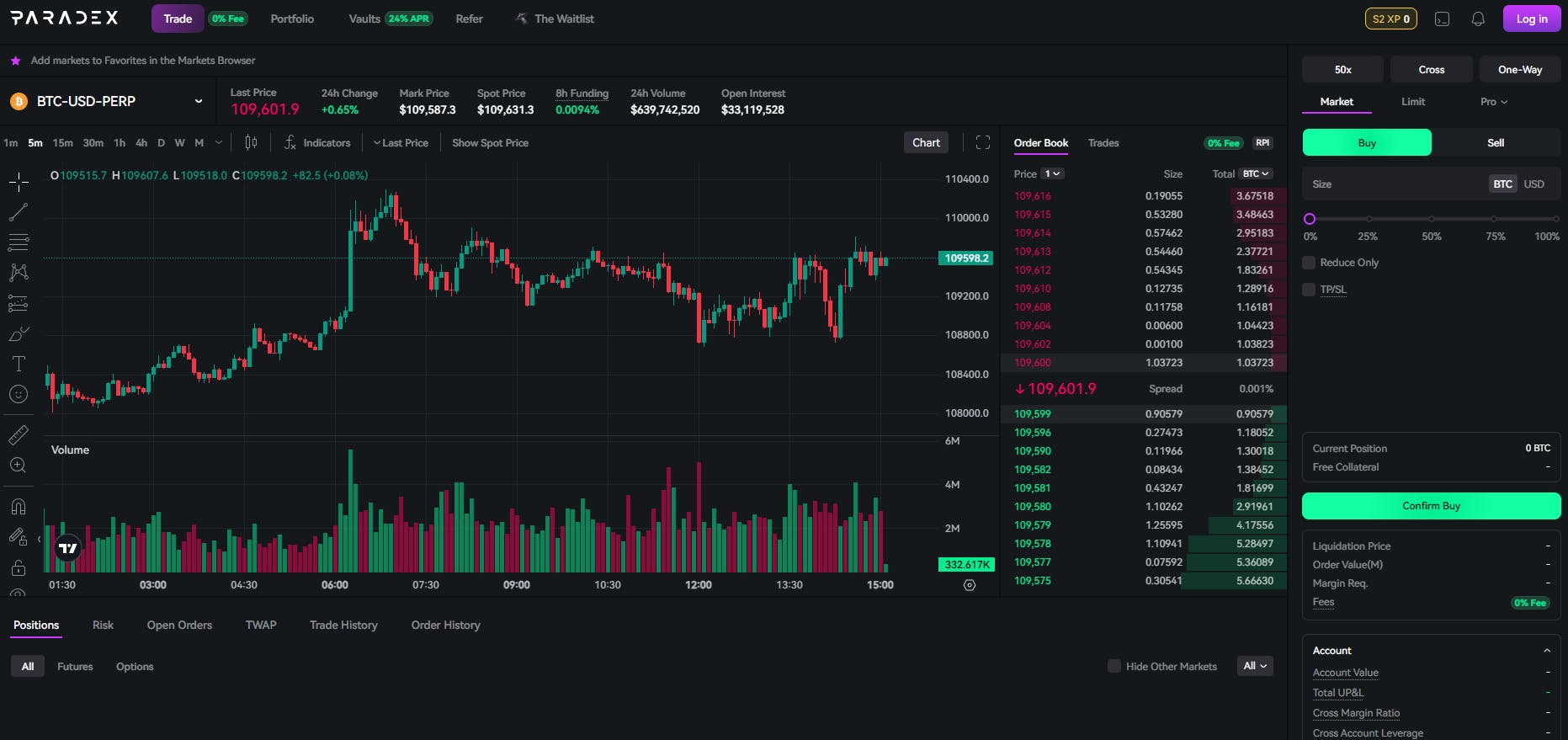

Paradex

Paradex is another DEX that uses a custom ZK Ethereum L2 chain, built on a Starknet stack, with a custom dedicated infrastructure for better performance. One of the platform’s primary focuses is institutional-grade privacy measures, including RPC masking and an encrypted orderbook.

Source: Paradex

Paradex also offers cross-chain bridges to top up quickly and develops secure off- and on-ramps for fiat deposits. Combined with its robust security instruments, the platform is a good choice for advanced Web3 users.

Jupiter

Jupiter is a Solana DEX that offers a variety of DeFi instruments, including the perpetual exchange. Supported by its robust liquidity pools with more than 11 million SOL locked, it's the largest Solana-based perp exchange as of October 2025, with about $500 million daily trading volume.

Source: Jupiter

This platform is a good choice for active Solana users who want to benefit from asset price fluctuations using a secure, non-KYC trading platform.

Perps and the future of trading

Perpetual contracts open secure and efficient trading without intermediaries, KYC, and custodial funds. Their users cannot be restricted based on their citizenship or location, and their funds cannot be suspended. Therefore, they are in line with the Web3 community ideals of decentralization, privacy, and security, and have a great growth potential.

While they rise as the primary competitors of centralized exchanges, it’s much better to see them as two complementary approaches, which can both be helpful for Web3 users. For example, CEX platforms can eventually become more decentralized and user-governed, while perp DEXs can use decentralized funds and onchain identity verification for better compliance and security.

The fact is, the blockchain market is developing faster and faster. Both CEXs and DEXs are growing, and both need blockchain infrastructure to scale—that’s why GetBlock always monitors the market.

We ensure that every blockchain project, from large international enterprises to small local apps, is supplied with secure, efficient, and decentralized RPC nodes. Sign up now and bring your infrastructure layer to the next level.

Popular Posts

June 9, 2021

4 min read

November 9, 2021

5 min read

May 24, 2022

5 min read

March 18, 2021

4 min read